Choosing the Right Reinsurance Program for Your Dealership: A Guide to Dealer Reinsurance Options

- Michael Dean Aufmuth

- Aug 17

- 2 min read

Updated: Aug 22

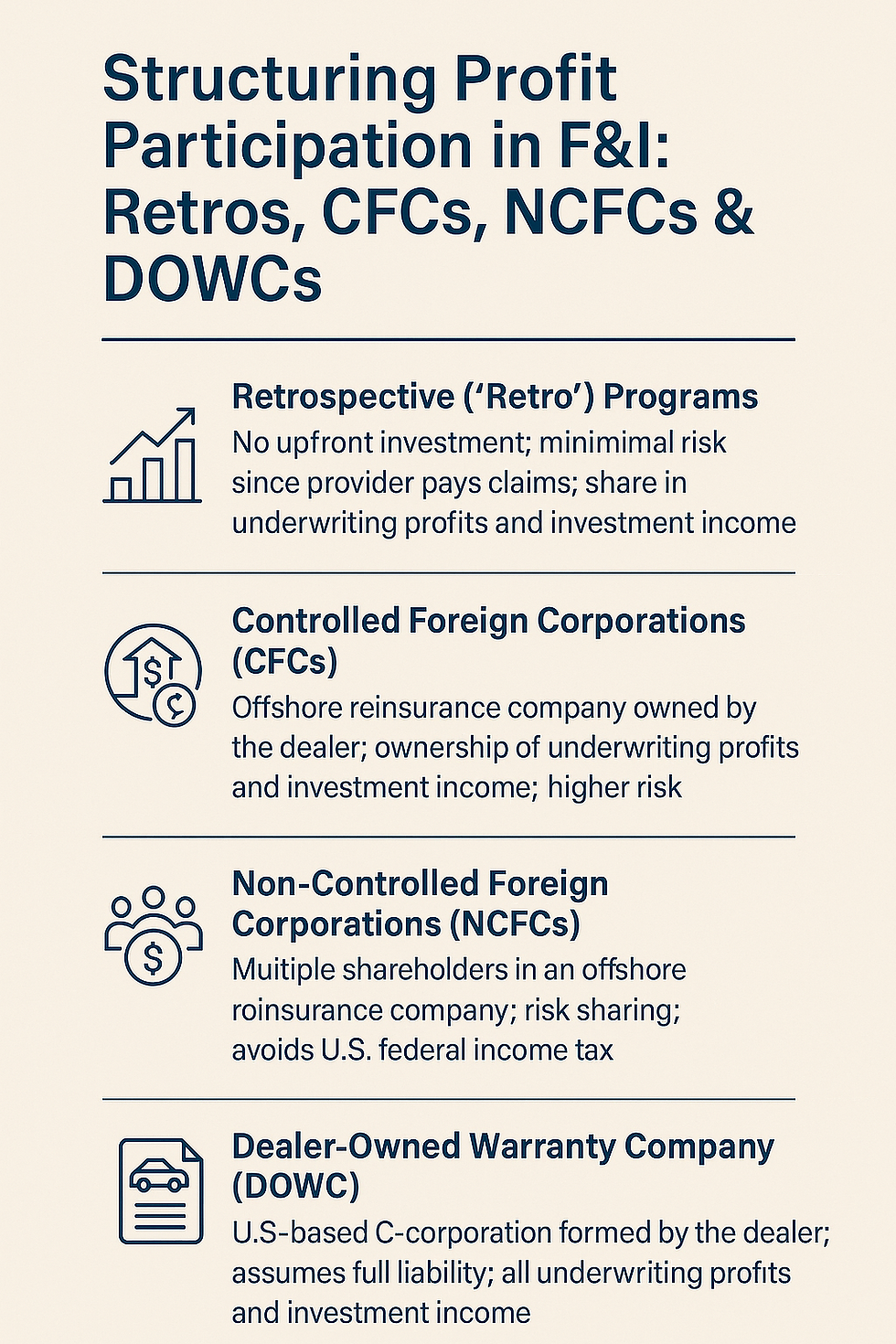

Dealer reinsurance is a game-changer. Instead of simply collecting a commission, you can harness the power of reinsurance to retain underwriting profits and investment income, ultimately driving more value back into your dealership.

But how do you choose the right dealer reinsurance program? From CFCs and NCFCs to DOWCs and hybrid models like the Super CFC, each structure offers unique benefits. Let’s break them down and see how Elite FI Partners can help you get started.

Understanding Dealer Reinsurance: The Basics

Reinsurance in a dealership context means setting up your own reinsurance company to reinsure the F&I products you sell. Instead of paying premiums to an outside insurer, your dealership’s reinsurance company earns the underwriting profits and investment returns. This approach can significantly increase your bottom line and provide tax advantages.

The Main Types of Dealer Reinsurance Programs

1. Controlled Foreign Corporation (CFC)

A CFC is an offshore reinsurance entity that can be treated as a U.S. taxpayer. It’s ideal for small to mid-sized dealers who want a straightforward, tax-efficient way to participate in dealer reinsurance profits.

2. Non-Controlled Foreign Corporation (NCFC)

For larger dealer groups, an NCFC allows multiple participants without direct control. It removes premium limits and offers a larger investment pool, making it a strong option in the reinsurance landscape.

3. Dealer-Owned Warranty Company (DOWC)

A DOWC gives you full control and branding over the products. It’s a domestic option that allows you to act as the obligor, offering strong reinsurance benefits but requiring more administrative work.

4. Super CFC

The Super CFC is a hybrid model that combines the benefits of a DOWC and a CFC. It’s perfect for larger dealerships looking for advanced reinsurance strategies.

How Elite FI Partners Can Help with Dealer Reinsurance

Navigating the world of dealer reinsurance doesn’t have to be daunting. At Elite FI Partners, we specialize in setting up customized reinsurance solutions tailored to your dealership’s size and goals. Whether you’re exploring a CFC, NCFC, or DOWC, our experts will guide you every step of the way.

We’ll help you assess which reinsurance structure fits best, handle the setup process, and ensure you’re maximizing the benefits of your chosen dealer reinsurance program.

Ready to explore your reinsurance options? Contact Elite FI Partners today and let’s build a reinsurance strategy that drives long-term profitability for your dealership.

Comments