Super Controlled Foreign Corporation (Super CFC)

A Smarter Path to Dealer Profitability

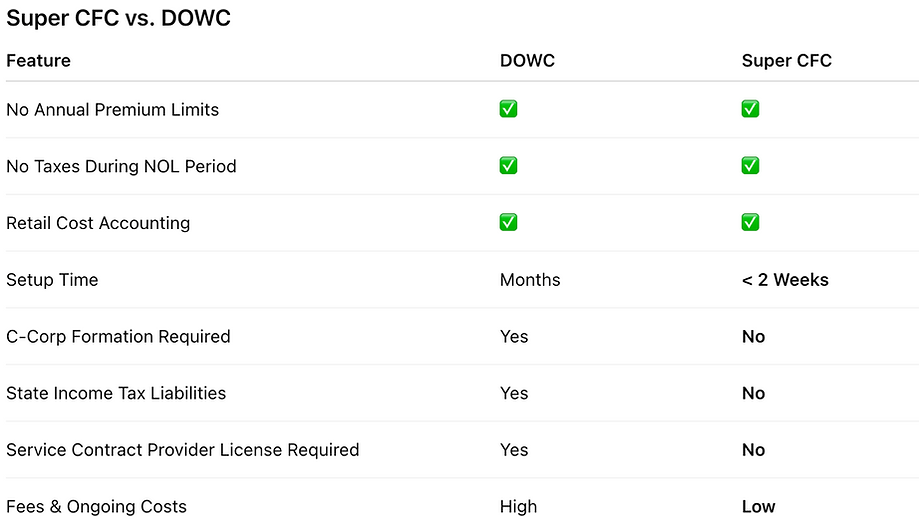

A Super Controlled Foreign Corporation (Super CFC) offers dealers a faster, more cost-effective way to maximize reinsurance profits without the high fees and slow setup of a Dealer-Owned Warranty Corporation (DOWC). By combining the tax advantages of retail cost accounting with no annual premium limits, a Super CFC puts you in control of your earnings from day one. With formation in less than two weeks, no service contract provider license required, and the flexibility to include all F&I products, this modern structure is built to increase your bottom line while eliminating unnecessary administrative burdens.

How A Super CFC Works

A Super Controlled Foreign Corporation (Super CFC) operates like a traditional Controlled Foreign Corporation (CFC) but with one major difference—it reports on a full retail cost accounting basis, similar to a Dealer-Owned Warranty Corporation (DOWC). This accounting method allows you to capture the entire retail value of your F&I products for tax purposes, generating larger initial losses (Net Operating Losses, or NOLs) and deferring taxes during the early years of the program.

Here’s how the process works:

-

Formation – Your Super CFC is set up as a dealer-owned reinsurance company. Because it sells administrator-obligor products (already approved in all states), you avoid the need for service contract provider licensing and state-by-state C-Corp formations.

-

Funding – Premiums from the sale of F&I products—such as service contracts, GAP, and other protection plans—are ceded to your Super CFC at the retail cost level, not the net written premium.

-

Accounting & Tax Benefits – Retail cost accounting creates a larger initial expense on your books, generating an NOL carryforward. During this period, no taxes are paid on underwriting gains.

-

Profit Realization – As claims are paid and unearned premiums are released, the NOL is reduced, and taxable profits begin to emerge—typically many years down the road.

-

Flexibility & Control – You have access to unearned premium releases when needed, along with the ability to include all F&I products without premium caps.

This combination of fast setup, tax efficiency, and limitless earning potential makes the Super CFC a strong alternative to both traditional CFCs and DOWCs for dealers who want maximum return with minimal red tape.

Key Benefits

-

No Annual Premium Limits – Unlike traditional CFCs, you’re not capped at $2.65M in premiums.

-

High Profit Potential – Maximize tax advantages and cash flow through retail cost accounting.

-

No Taxes During the NOL Period – Generate large tax losses in the early years with Net Operating Loss (NOL) carryforwards.

-

Fast Setup – Avoid state-by-state C-Corp formations and be up and running in weeks, not months.

-

No Service Contract Provider License Required – The administrator is already approved nationwide.

-

Flexibility in Products – Works with all F&I products, including GAP.

-

Unearned Premium Releases Available – Access capital when needed.

How It Compares To Other Programs

-

Profit Share Agreement – Easiest entry point, but taxed as ordinary income and offers no preferential tax treatment.

-

Traditional CFC – Strong long-term strategy with tax advantages, but limited by annual premium caps and net written premium accounting.

-

Super CFC – Combines the tax benefits of retail cost accounting with the ease and flexibility of a CFC, while eliminating the costs and delays of a DOWC.

Why Dealers Choose Super CFC

-

The Super CFC model gives dealers the speed, flexibility, and tax advantages needed to maximize profitability without being weighed down by administrative burdens. It’s ideal for dealers who:

-

Want to move beyond CFC premium caps

-

Need a faster, more cost-effective alternative to a DOWC

-

Are looking to capture higher profits without additional licensing requirements