Structuring Profit Participation in F&I: Retros, CFCs, NCFCs, and DOWCs

- Michael Dean Aufmuth

- 5 days ago

- 2 min read

By Michael Aufmuth, Elite FI Partners

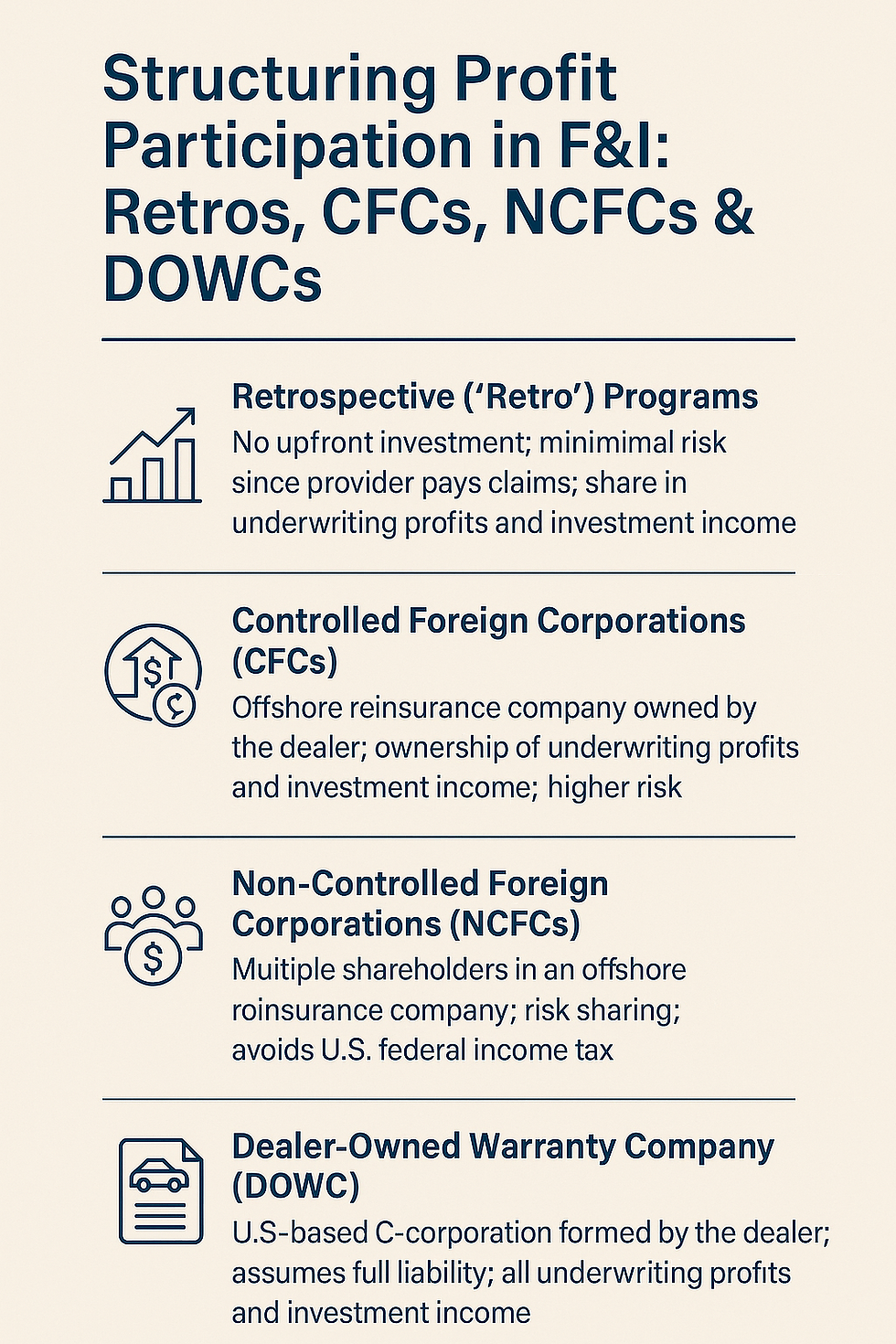

As many dealers know, not all profit-sharing programs deliver what they promise. Some underperform, others are inappropriate for your scale, and in some cases, fees and expenses consume any real profit. That is why it is critical to understand the landscape from low-risk structures like retros to more complex formations like dealer-owned warranty companies (DOWCs) and find the model that builds long-term wealth, not just short-term revenue.

Retrospective (Retro) Programs

Retros are often the entry point for dealers exploring profit participation. They require no upfront capital and pose minimal risk since your provider underwrites and pays claims. Dealers share in underwriting profits and investment income. Payouts are taxed as ordinary commission income, and they are typically limited to service contract type products.

Controlled Foreign Corporations (CFCs)

With a CFC, you form your own offshore reinsurance company and take ownership of underwriting profits and investment income. Although risk is slightly higher, the upside, especially under an 831(b) tax election, is substantial since you are taxed only on investment income. All products can be included. This structure offers enhanced control and flexibility for wealth building, especially for mid-size and larger dealerships.

Non-Controlled Foreign Corporations (NCFCs)

NCFCs operate similarly to CFCs but involve multiple shareholders, offering risk sharing and reduced administrative burden. Dealers participate by holding shares rather than owning outright, and the structure avoids U.S. federal income tax while paying a 1 percent excise tax. This structure is ideal for larger groups that exceed CFC limits or seek diversification.

Dealer-Owned Warranty Company (DOWC)

A DOWC is a U.S.-based C-corporation formed by the dealer to underwrite service contracts directly. The dealer assumes full liability and reaps all underwriting profits and investment returns. Tax liabilities are often deferred for five to seven years due to retail cost accounting, but the structure comes with higher capital and regulatory requirements.

Choosing the Right Structure

Deciding on a structure hinges on evaluating four critical factors: risk tolerance, desired participation level, taxation, and eligible products. A well-informed decision will align with both your short-term operating goals and your long-term wealth strategies.

Why Some Dealers Are Not Seeing Returns

Even when enrolled in profit-sharing, many dealers miss out due to poorly matched structures, excessive expenses, or high fees. You deserve better: a structure tailored to your needs, not one forced into your business. Whether your current program is underperforming, unsuited, or simply expensive, there is an opportunity for transformation.

What Elite FI Partners Offers

We work with dealers in 24 states to evaluate, design, and implement profit-sharing programs that align with your goals. Whether that means analyzing your current structure or adding a more lucrative model, we will show you how participation can become a true wealth-building tool. We handle the entire process from comparing retros to modeling tax-efficient formations like CFCs, NCFCs, or DOWCs so you can make confident and strategic decisions.

Let us show you the possibilities and how the right program can become one of your dealership’s most significant long-term advantages.

Comentários