Dealer-Owned Warranty Company (DOWC) – Comprehensive Guide for Dealerships

Dealer-owned reinsurance programs have transformed how auto dealers capture and retain profits from F&I products, turning what was once a simple commission into a long-term wealth-building strategy. Among the various structures available, one of the most talked-about and increasingly popular options is the Dealer-Owned Warranty Company (DOWC). Unlike traditional setups that rely heavily on third-party insurers or offshore entities, a DOWC gives dealers the opportunity to create and manage their own U.S.-based warranty company, offering greater control, transparency, and branding flexibility. On this page, you’ll find a practical, U.S.-focused overview of DOWCs — what they are, how they operate, and why more dealers are considering them. We’ll also compare the DOWC to other common reinsurance structures such as Controlled Foreign Corporations (CFCs), Non-Controlled Foreign Corporations (NCFCs), and Super CFCs, so you can clearly see the differences, advantages, and trade-offs of each.

What is a Dealer-Owned Warranty Company (DOWC)?

A Dealer-Owned Warranty Company (DOWC) is a specialized corporate structure in which the auto dealer establishes a U.S. domestic C-corporation to act as the service contract provider (obligor) for the dealership’s F&I products (e.g. vehicle service contracts, maintenance plans, etc.) In a DOWC program, the dealer’s new company sells and administers the warranties/service contracts to customers, rather than relying on a third-party warranty provider. This means your dealership essentially “owns” the warranty business and is directly responsible for covering claims under those contracts.

Crucially, a DOWC is not regulated as an insurance company by state insurance commissioners since it provides warranties/service contracts (non-insurance products.) However, for federal tax purposes, the DOWC entity is typically treated as an insurance company (assuming it meets IRS criteria for risk distribution.) The DOWC must usually register as a service contract provider in each state where it operates, complying with any state-specific licensing, reserve, or form filing requirements. Dealers often partner with a third-party administrator (TPA) for support. The TPA can handle administration, claims adjudication, and help ensure compliance while the dealer’s DOWC retains the risk and profits. Additionally, DOWC programs typically include a Contractual Liability Insurance Policy (CLIP) from an insurer to back the DOWC’s obligations (a “failure to perform” policy that insures claims if the DOWC cannot pay.)

In summary, a DOWC structure puts the dealer in the driver’s seat as the obligor of F&I products. You form your own warranty company, gain full transparency into the program’s performance, and capture underwriting profits and investment income that would otherwise go to a third-party provider. This direct control and ownership can unlock new revenue streams and customer loyalty benefits, but it also comes with greater responsibility and complexity, as we’ll explore.

How Does a DOWC Generate Profit (and Tax Benefits)?

The most significant advantage of a DOWC is the ability to retain all underwriting and investment profits. Instead of earning only a commission, the dealer-owned company captures the profit that third-party insurers usually keep.

From a tax perspective, DOWCs often show losses in the first several years due to how expenses are recognized. This creates net operating losses that can offset future taxable income. As contracts are earned over time, profits are realized gradually, allowing for deferred taxation and long-term growth.

Because the DOWC is a U.S. corporation, it avoids the complexity of offshore entities while still benefiting from deferred income recognition in its early years.

Benefits of the DOWC Structure

-

Full Control: Customize your warranty programs, pricing, and branding.

-

Higher Profit Potential: Keep 100% of underwriting and investment income.

-

Customer Retention: Claims and service drive customers back to your dealership.

-

Tax Deferral: Upfront expenses create tax advantages in the early years.

-

U.S.-Based Simplicity: No offshore filings, foreign banking, or premium caps.

-

Challenges and Considerations

While powerful, DOWCs require more involvement than traditional reinsurance programs:

-

Operational Complexity: Running a warranty company requires separate accounting, reserves management, and compliance.

-

Capital Requirements: DOWCs need significant startup capital and reserves.

-

Regulatory Burden: Must be licensed as a service contract provider in each state.

-

Future Taxation: Profits eventually become fully taxable at corporate rates.

-

Double Taxation Risk: Distributions may be taxed again as dividends.

-

Product Limitations: DOWCs can’t directly cover insurance products like GAP.

-

Exit Strategy: Transitioning out of a DOWC requires running off contracts, which can take years.

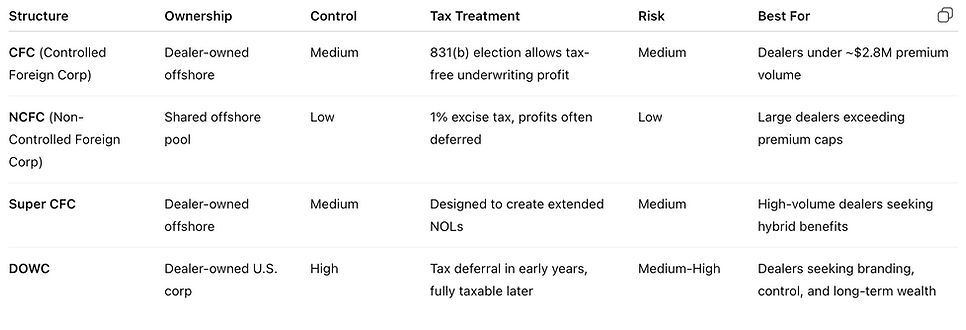

DOWC vs. Other Reinsurance Structures

Here’s how DOWCs stack up against other common structures:

Why Consider a DOWC?

A DOWC is ideal for growth-oriented dealers who want complete control over their warranty programs, branding, and profits. It’s not as simple as a CFC or NCFC, but for the right dealer group, it can be a powerful wealth-building tool.

The key is aligning the structure with your dealership’s scale, goals, and resources. Smaller dealers may prefer a traditional reinsurance model, while larger groups looking for control and branding often find a DOWC attractive.

Whether you choose a CFC, NCFC, Super CFC, or DOWC, the most important decision is to participate in reinsurance at all. Each structure has advantages, but all share the same goal: to keep more of the profits generated by your F&I products inside your dealership.

By understanding the DOWC structure and how it compares, you can make an informed decision about which program fits your dealership’s vision for growth and profitability.